This project analyzes and forecasts the stock prices of Apple Inc. (AAPL) and Honeywell International Inc. (HON) using advanced time series forecasting techniques. The analysis spans 252 market days, employing methods like exponential smoothing, weighted moving averages, and regression analysis to predict stock prices and evaluate forecasting accuracy.

Short-Term Forecasting:

Long-Term Forecasting:

Regression Analysis:

Portfolio Optimization:

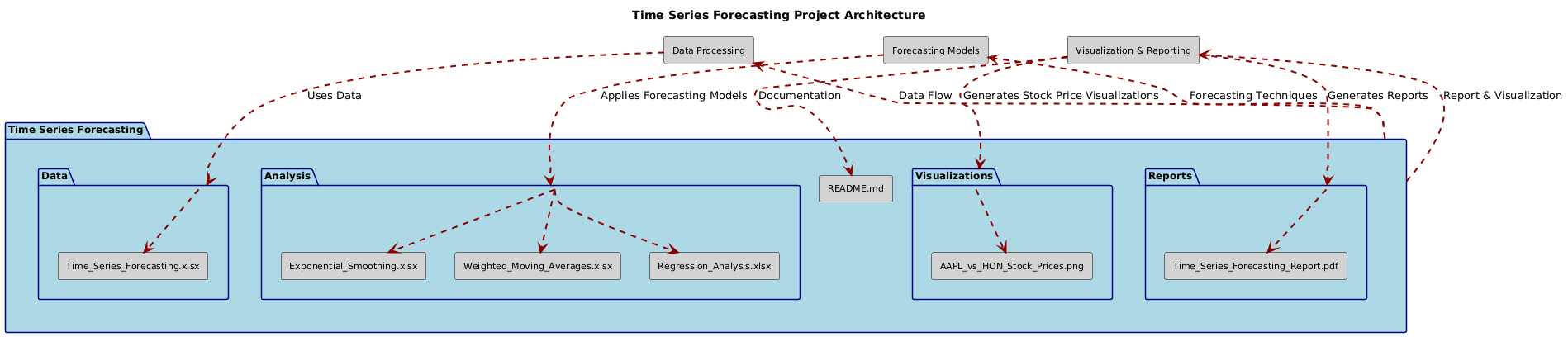

. ├── Data/ │ ├── Time_Series_Forecasting.xlsx ├── Analysis/ │ ├── Exponential_Smoothing.xlsx │ ├── Weighted_Moving_Averages.xlsx │ ├── Regression_Analysis.xlsx ├── Visualizations/ │ ├── AAPL_vs_HON_Stock_Prices.png ├── Reports/ │ ├── Time_Series_Forecasting_Report.pdf ├── README.md

For a detailed analysis, including methodology, formulas, and visualizations, refer to the full report:

📄 Time Series Forecasting Report

Feel free to reach out for feedback, questions, or collaboration opportunities:

LinkedIn: Dr. Syed Faizan

Author: Syed Faizan

Master’s Student in Data Analytics and Machine Learning

© 2025 Syed Faizan. All Rights Reserved.